Organize Liquidity Efficiently

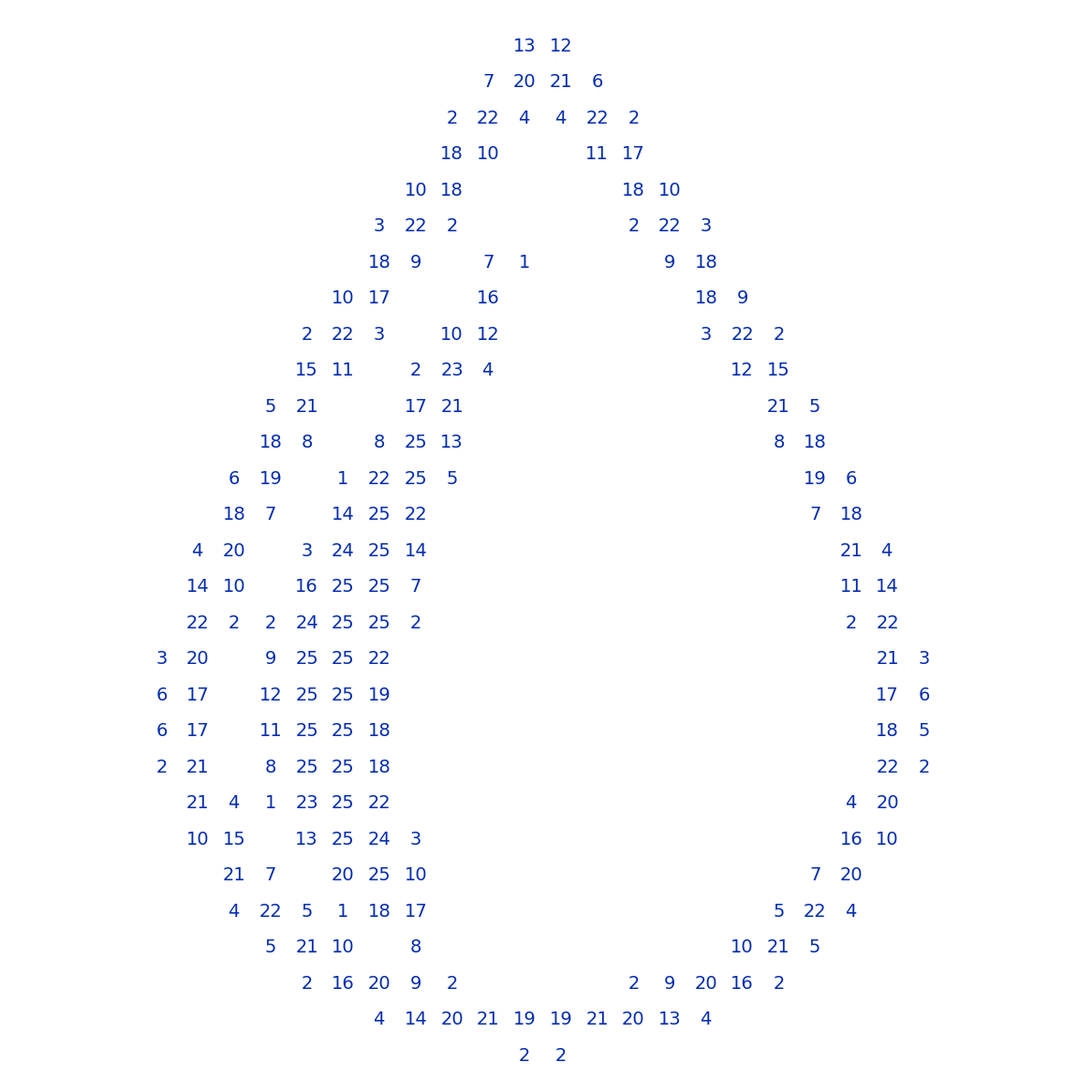

A company's business model is its beating heart, providing the vital resources to operate through a continuous flow of liquidity. Purchase, production, sales, and finance—each department has the financial resources to perform its specific functions effectively. A constant flow of liquidity is essential for each department to perform its tasks efficiently. As the company progresses, so do the requirements for the supply situation, and these changes often hold considerable potential for optimization.

My consulting approach is to offer a transparent analysis of liquidity requirements along the entire value chain. In doing so, I identify and define liquidity potentials and successively optimize the liquidity supply. Together, we define KPIs as guidelines for your liquidity management to build a supply system that can efficiently adapt to new or changing requirements as the company progresses. Liquidity management will then make a significant contribution to the solvency and profitability of your company and significantly increase the value of the company. I see liquidity as a value stream in the business model and recommend managing it as an asset class.